In April, UnitedHealthcare announced its plan to exit 26 of its 34 healthcare exchanges beginning in 2017. To many, this didn’t come as a surprise, as the insurer had been warning since late last year that the exchanges were a risky investment. (To date, Aetna, the nation’s third-largest health insurance provider, Humana, the fifth largest health insurance company in the U.S., and Blue Cross Blue Shield of North Carolina have also pulled subsidized health plans from select states—citing financial losses as the primary driver.)

Not to mention, acquisitions and mergers in process—Aetna to acquire Humana and Anthem to take over Cigna—will likely mean fewer choices for consumers in the future.

However, for carriers prepared for the invariable flux that occurs with all things insurance-related, change isn’t always a bad thing. Even as big names exit the Affordable Care Act, other providers are doing just the opposite: designing and pricing their plans according to Obamacare’s subsidy structure—and they’re making a profit from exchange coverage.

For instance, Centene, a St. Louis insurer, acquired Health Net earlier this year and reported a 30 percent increase in ACA customers at the end of March. For those in the know, this is no surprise—Centene has successfully catered to the low-income individual market and has done so far better than its rivals. Anthem, another insurer, projected a three to five percent profit margin on the exchanges in 14 states where the company sells Blue Cross and Blue Shield policies. In addition, Molina Healthcare has also seen positive results since being in the exchanges, reporting an aggregate membership increase of 26 percent compared to the second quarter of 2015.

For the everyday American, however, such changes in the industry are mere semantics—most will want to know how and when they will be affected (it at all), as well as how their carrier or broker is prepared to help them through any upcoming transitions. Here is a breakdown of the ways consumers can expect to be affected by these recent changes, as well as new challenges—and opportunities—they may create for smaller carriers and brokerages.

Limited options.

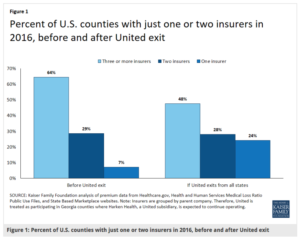

During the 2017 open enrollment period, consumers signing up for health insurance in some states will likely face fewer choices. For instance, UnitedHealthcare’s decision to leave certain exchanges will have a significant impact on consumers in rural areas and southern states where more than half their counties now have only one insurer participating in the exchanges. Analysis from the Kaiser Family Foundation (KFF) indicates the states that will most feel the pinch are Alabama, Arizona, Florida, Kansas, Mississippi, Oklahoma, and Tennessee.

What this means for brokerages: less competition, more opportunities for growth.

Moving forward, brokers  will need to take a more hands-on approach, positioning themselves as professional customer advocates. For consumers in need of further explanation regarding recent changes, insurance brokers are in the perfect position to lend this assistance. There will also be more opportunities for small carriers to enter the ACA marketplace. Now is the time to appoint yourself with regional carriers, like Molina and Centene, and seize the chance to expand your selling regions.

will need to take a more hands-on approach, positioning themselves as professional customer advocates. For consumers in need of further explanation regarding recent changes, insurance brokers are in the perfect position to lend this assistance. There will also be more opportunities for small carriers to enter the ACA marketplace. Now is the time to appoint yourself with regional carriers, like Molina and Centene, and seize the chance to expand your selling regions.

Possible disruptions in care.

When insurers pull their healthcare plans out of the exchanges, consumers have the potential to see disruptions in continuative care. In these cases (when an insured must obtain coverage with another carrier), there’s always a possibility that their current doctor isn’t in the new carrier’s network or that certain prescription drugs may not be covered.

What this means for brokerages: customers will need proactive service and additional attention.

Contributing to the existing complexity of the ACA, changes to policies will likely add some confusion for consumers. But for brokerages that prioritize retention (and ultimately, renewals and revenue), a proactive approach will help customers make sense of these changes.

This means being well versed in upcoming changes. For brokerages in affected states, it will be more important than ever to explain new coverage limits and changes in terms. Brokers should help make sure an enrollee’s provider is in-network and that the insured is covered for their existing prescription drugs.

Potential premium increases.

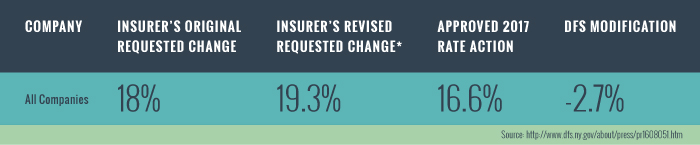

According to KFF’s analysis, UnitedHealthcare’s participation on the exchanges had a relatively small effect on premiums, but their withdrawal could impact certain markets (such as those mentioned above). It is certainly possible that other providers may raise their premiums, although state and/or federal rate reviews may help to offset this trend. While the impact over the long term is unclear, premium changes should be expected due to the newness of the ACA marketplaces.

What this means for brokerages: the need for agility.

Due to the potential financial impact to consumers, brokers should be prepared to help insureds to shop around and switch plans when necessary. Specifically, agents must have a thorough understanding of available carriers and associated coverage, and be prepared to discuss premium changes and alternate coverage options.

It’s helpful to note that with change comes opportunity, too. This is an ideal time for agents to look closely at the growing market of STM insurance, life insurance, and other ancillary products such as dental, vision, accident, and critical illness insurance.

Looking ahead

As for the long-term effects of the latest round of exits and acquisitions, it’s important to remember that the current climate is not all doom and gloom. The marketplaces play a special part in health insurance, they are also a fairly modest part of the entire insurance system. And, while some of these transitions have the potential to disrupt the industry, for carriers and brokerages poised for change, significant opportunities exist. Agents can still be successful and experience financial growth in this business.

That said, due to such extensive changes in the industry—including some carrier exits and others recalibrating their insurance plans—an agent simply can’t afford not to have a sales management solution in place. With the unprecedented opportunities that arise from STM insurance and other products such as dental and vision, there’s no better time to capitalize on the options available to be profitable in the insurance business. We invite you to learn how AgentCubed can help revolutionize your approach and maximize your profitability—despite the ever-changing landscape of our industry.

Login

Login